Gather supporting documents

Please gather all supporting documents for your claim.

For the supporting documents required for each type of claim, please refer to the Supporting Documents section below.

Complete and submit claim form

Download and print the claim form (as needed):

In-Patient Claim Form

Out-Patient Claim Form

Death Claim Form

Cancer Claim Form

- Fill up the claim form and mail it with supporting documents to:

Accident and Health Claims Department

MSIG Insurance (Thailand) PCL.

1908 MSIG Building, New Petchburi Road

Bangkapi, Hauykwang, Bangkok 10310

- You may also scan and email the completed form with supporting documents to:

- E-mail: Click here

- Fax: +66 2718 1502

Remark: Where necessary, please also mail the original receipts and documents.

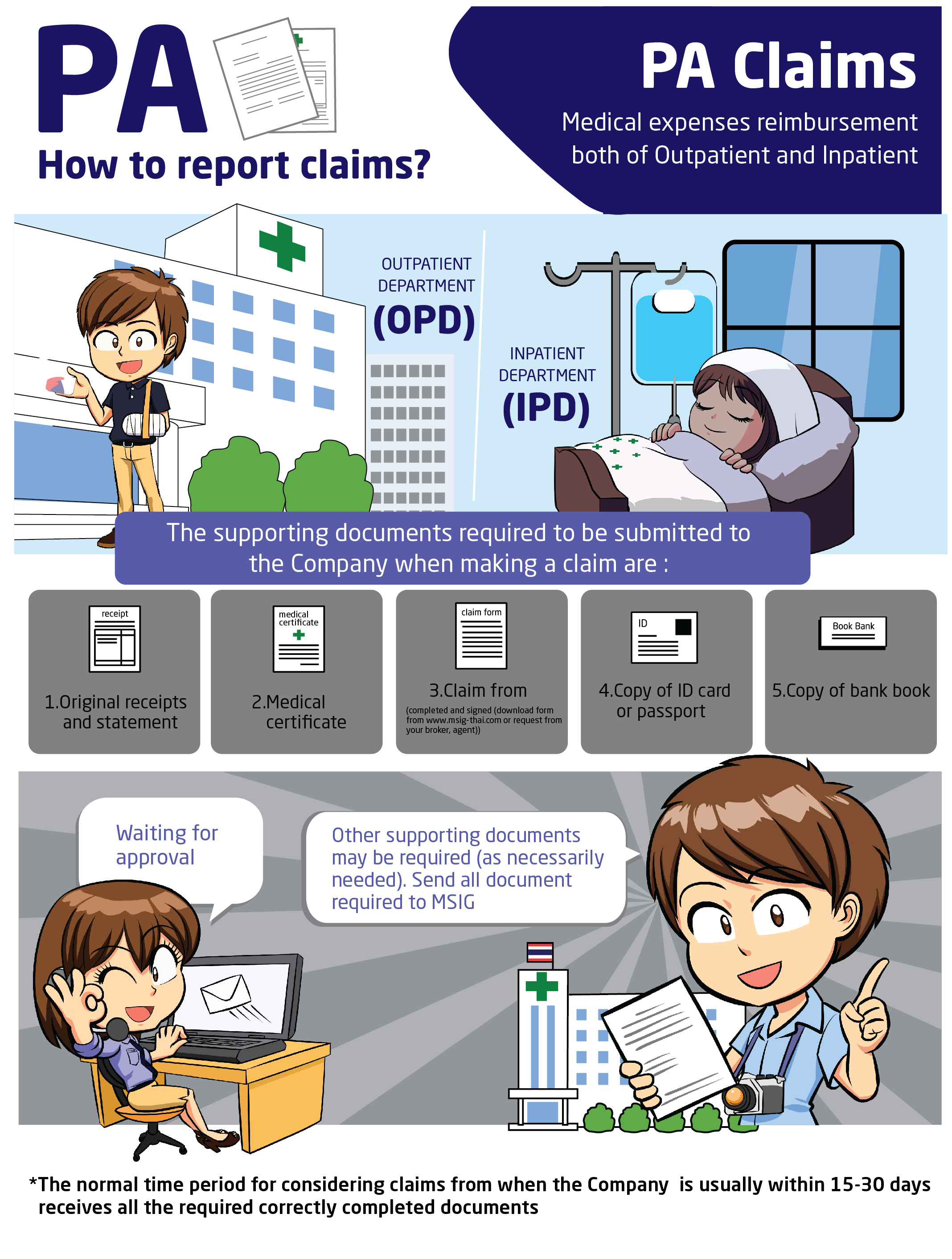

Out-Patient (OPD) Medical Expenses

- Completed OPD medical expenses claim form

- Medical certificate (issued by a doctor/hospital) or completed claim form (Medical Certificate section)

- Original hospital receipt(s)

- Signed copy of the insured identification card or passport

- A copy of bank book (to facilitate transfer of claim payment)

In-Patient (IPD) Medical Expenses

- Completed IPD medical expenses claim form

- Medical certificate (Issued by a doctor/ hospital) or completed claim form (Medical Certificate section)

- Original hospital receipt(s)

- Signed copy of the insured identification card or passport

- A copy of bank book (to facilitate transfer of claim payment)

Hospital Benefit (HIB/ HAB)

- Completed OPD or IPD medical expenses claim form

- Medical certificate (Issued by a doctor/hospital) or completed claim form (Medical Certificate section)

- Copy of hospital receipt and invoice with authorisation signature from the hospital officer

- Signed copy of the insured identification card or passport

- A copy of bank book (to facilitate transfer of claim payment)

Accidental Death

- Insurance policy

- A completed claim form of the company (Death Claim Form).

- A copy of Death certificate.

- A copy of autopsy report, certified by the Case Officer or issuing authority.

- A copy of the police report, certified by the Case Officer or issuing authority.

- A copy of the identify card and house registration of the Insured stating the Insured is “deceased”

- A copy of the identify card and house registration of the beneficiary.

- A copy of the Insured’s passport.

- Certificate letter of Death verification from the hospital (if any)

- Report of blood alcohol test from Police Forensic Science (if any)

- Medical certificate (if any)

- Other documents as required by MSIG.

Dismemberment or loss of sight or total permanent disability

- A completed claim form of the company.

- A report of the attending physician certifying the Insured has suffered from total permanent disability or dismemberment or loss of sight.

- Insured’s photograph showed organ of dismemberment or loss of sight.

- A copy of the Insured’s passport.

- Other documents as required by MSIG.

Remark: If the documents are insufficient, the Claim Administrator may request for more documents.

The normal time period for considering claims when MSIG receives all the necessary complete documents is usually within 15 days.

Claim payments will usually be made within 15 days from the date the claimant has agreed to the amount of compensation.

In cases where there is reasonable doubt regarding the validity of a claim according to the stated policy coverage, the time periods stated above may be longer but reasonable and no longer than necessary, usually not longer than 90 days from MSIG receiving all the necessary completed documents.

Remark: The above time periods are guidelines and are not legally binding. The consideration of claims shall depend on the terms, conditions and exceptions of each insurance policy. MSIG may ask for further information and supporting documents before concluding the assessment of any claim.

The latest update is according to OIC Notification: Rules, Method, Conditions, and Period of Compensation Reimbursement or Payment under the Insurance Contract, and Cases deemed as a Delay of Claims Payment or Refund Premium of the Non-Life Insurance Companies, B.E. 2566 (2023).

Contact Us

Claim notification:

MSIG Claims Hotline (24 hours): 1259

Submit claim:

Email: Click here

Fax: +66 2718 1502

(Where necessary, please also mail the original receipts and documents separately.)